This year saw the cut in the solar Feed-in Tariff (FiT) come into effect. This means that people who install solar panels will receive far less money from the government than they used to – dropping from 12.03p/kWh to just 4.25p/kWh.

Unsurprisingly, the number of solar panel installations has begun to drop as people become more wary of recouping their costs. The number of installations in the first quarter of 2016 was still one of the highest since 2012, but a drop of over 60% in the tariff is beginning to cause concern.

It’s worth noting that you don’t only get money back from the FiT itself. To start, you’ll save money on your bills as you make use of the sun’s free energy, while you also make money from a separate export tariff – this is where excess energy is sent back to the grid.

So, are solar panels still a worthwhile option? Well, there’s no one stock answer. There’s quite a few factors at play in regards to your home and its location, plus it depends on what you consider a decent return when it comes to timeframes.

The Energy Saving Trust have put together a great calculator so you can get an idea of the money you’ll be saving and generating over time. But before you start, you’ll need to know your:

If your home has an Energy Performance Rating of D or above, then you’re good for the full FiT payout. If not, you’ll get just 0.61p/kWh which means you’ll be unlikely to recoup your installation costs for a very, very long time. It might be worth looking into fixing this as you’re probably paying more for you bills already.

This includes:

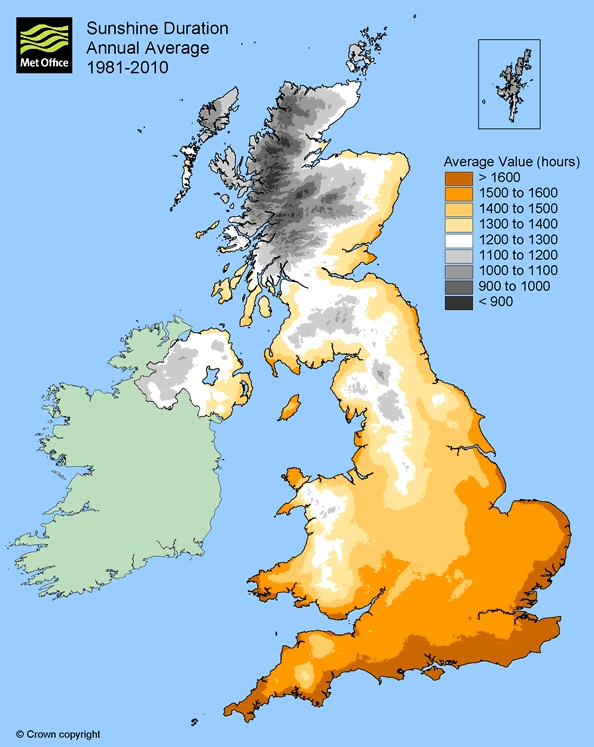

This is to help workout how much solar energy you’ll be able to take advantage of. Your location will also play some part. While solar panels can still generate energy on a cloudy day, the more sunlight you get the better. This map from the Met Office will show you the best place for sunny days:

Source: Met Office © Crown copyright. Contains public sector information licensed under the Open Government Licence v1.0 (terms of use at end of post)

Source: Met Office © Crown copyright. Contains public sector information licensed under the Open Government Licence v1.0 (terms of use at end of post)The calculator will spit out some data for you. This might give you the first inkling about whether or not solar panels are something to consider.

According to this piece from Money Saving Expert (that also offers some decent advice on the subject), the typical household will need 22 years before they pay off the installation costs of their solar panels. That’s not exactly a quick return on an investment.

Having said that, once that time has passed you’ll be making a guaranteed profit. Then of course, it might take a lot less time depending on the factors previously mentioned. So, with a good slant on your south-facing roof in Cornwall you might be in the black much sooner.

Then there’s the fact that technology might begin to change. Solar panels are already vastly more effective than they were in the past. As you can see from this chart (or this far more detailed one), not only has existing technology been improved on, but new types of cells have been created with far higher levels of efficiency.

Back in 1975, no type could reach 15% efficiency. Now we have cells that have surpassed 40%. There’s even new developments that could improve existing cells without replacing them entirely. This could be a reason for holding off in case we see significant improvements in the near future that will make recouping costs far quicker.

When it comes down to it, if you’re happy to shell out for solar panels, which will bring a cost likely over £6,000, and spread the cost over a couple of decades, then go for it. The FiT and export tariff are both linked to inflation so you won’t get caught out that way at least.

It’s not all about the money though. Whether it takes 10 years or 30 years to get your costs back, you’re still helping to lower our reliance on fossil fuels. Sure, adding solar panels to your two-bed in Dagenham isn’t going to save the planet, but for many just doing something is enough to get them investing in solar.

In the end, whether solar panels are worth it is going to be down to your specific situation and motivations. Do your research, make some calculations, and you’ll soon have your answer. Whatever you do though, don’t rush into a decision too quickly.

Mention PPI to the everyday person in the UK and you’ll generally receive a response which, when removing the expletives, makes reference to those annoying nuisance calls!

Most of us will have had them in the past and due to poor regulation it is likely we will continue to receive them until real deterrents are put in place.

Some of us will have registered our contact numbers with the Telephone Preference Service (TPS), which is designed to stop such calls but the reality is these calls can continue.

So, how do we fight back and why is a PPI company telling you how?

Quite simply, we are encouraging the public to fight back against these cold calling companies as it is unfair that the good guys are being tarnished with the same brush as the businesses who use aggressive, and sometimes illegal, marketing tactics such as cold calling, SMS texts and emails.

The tactics used by banks and finance providers when handling PPI complaints and information requests, which have led in many instances to regulatory fines, mean genuine PPI companies out there do offer a valuable service.

The down side to the demand for the services of a Claims Management Company (CMC) is that many unscrupulous businesses have popped up, so I’ve completed a guide on how to choose a good CMC.

Many of us have received text messages purporting to know how much PPI compensation we are owed, with some even stating a figure, and all we have to do is respond to the text to make the claim.

These texts are simply scams and should be avoided at all costs.

I suspect many of us have also responded with ‘STOP’, or perhaps words of that description!

If you have responded in a manner which would encourage the process to begin however, it is likely a call will have followed shortly thereafter.

Once a cowboy CMC has you on the telephone they have one aim and that is to get you to sign up for their service, and the tactics I have experienced when receiving such calls are scandalous.

It may or may not be a shock to you but in all the cold calls I have received I have NEVER received one that I consider to be compliant, and I know the industry.

When I first started receiving PPI cold calls I was curious to witness what tactics and sales pitches were being used, and I was frankly disgusted with what I heard.

From claiming to know how much I was owed, to implying they are part of the government or the bank, these cowboys used so many tactics in order to obtain business.

Below are some of the more common lies that I heard….

I couldn’t do the claim myself as my account was opened more than 6 years ago.

This is not true.

Whilst providers may attempt to fob customers off by claiming they do not hold records going back further than six years, we’ve seen archived records being retained going back to the early 1980’s.

The CMC would obtain a higher amount of compensation than if I did the claim independently.

This is also untrue.

Whilst providers may use various tactics which has included not looking into all accounts, when it comes to calculating offers of compensation they have strict guidelines they must abide by.

It is simply a case of reading a compensation offer letter properly to ensure you’re being offered a fair amount, and not a ‘partial’ offer.

The CMC had a better chance of success than if I did the claim independently.

Our regulator clearly states a CMC cannot claim this to be true.

This is because a CMC cannot possibly know the level of knowledge any individual may have regarding making claims, their ability to overcome tactics and/or objections raised by providers, or the time they may have available to build and manage the claim.

I decided it was time to fight back against the cowboys who were clearly in breach of clear regulatory rules, and using such underhand tactics to try and obtain customers.

It was clear to me that the average UK consumer could quite easily be targeted and conned by the tactics used, so I decided to download a call recording app to my mobile and recorded all calls received.

Once the app was downloaded is was simply a waiting game, and it didn’t take long for the calls to start coming.

Firstly it is important to obtain details about the CMC that is calling as you need to have a place to send your complaint into should the call not be compliant.

Once I had the details of the company it was just a matter of asking questions that a potential customer may ask.

Questions such as “is this something I can do myself?”, “why should I use your company?”, would generally see the caller launch full speed into their tactical and misleading sales pitch.

With the call recorded it was simply a case of building a complaint and emailing it to the company along with the recording, who would then have up to eight weeks to respond.

One of the first points of complaint would be how and when did they obtain my details, as this can eventually lead to uncovering a potential breach of the Data Protection Act.

The remaining points of complaint would be surrounding the claims and statements made by the representative.

In the majority of instances I would receive a response to my complaint which would claim the person I spoke to was new to the business, which raised greater concerns as surely the training receive would be fresh in the mind of the representative.

If I was unsatisfied with the response I simply forwarded it, along with the call recording and complaint, to the Claims Management Regulator.

In a few instances I received an offer of compensation from the cowboy company, which has totaled over £1,000 to date.

In one instance I managed to trace the source of who sold my details to the CMC and found there to have been a clear breach of the Data Protection Act, given I had categorically stated I did not give permission for my details to be passed on. That compensation award ran into thousands of pounds.

It has now got to the stage these days where I actually look forward to receiving cold calls.

Who knows, maybe you will start looking forward to receiving such calls, let the fightback commence people!

...